Quick Start

1

Set up bank accounts and initial balances in Cash Tracker

- Add your bank accounts (chequing, savings, crypto, retirement cash accounts) and the respective initial balances as-of the day you want to start tracking.

- You can set week-ending preference for weekly view, but the default weekday is based on today.

2

Set expected recurring revenue and expenses in Cash Tracker

- Add salary, rent/mortgage, daycare, insurance, subscriptions, etc., and choose recurring frequency specific to your situation. For example, repeat every X day/week/month/year with start date, amount, and end conditions.

- Edit, skip, or override any future recurring instances to reflect what will actually happen.

- Add one-off transactions and transfers to complete the financial picture.

3

Check your forecast 30–180 days ahead in Cash Tracker (and beyond if needed)

- Use Quick Select to see the current Month, next 3 Months, next 6 Months, or next 1 Year—or set a custom range.

- Toggle Weekly, Monthly, Quarterly, or Yearly views to see cash timing and compare balances between periods.

4

Check your Net Worth in Networth Tracker

- Cash balances from Cash Tracker flow in automatically and are not editable in Networth Tracker.

- Add other assets (RRSP, TFSA, crypto, real estate, other investments) and liabilities (mortgage, HELOC, other loans).

- Use the Log to track dated changes and keep a clean history.

5

Set monthly budgets, upload card CSV, and auto-categorize in Budget & Spending

- Click Upload and select a CSV credit card statement file from your bank or card provider.

- Sonnet Money auto-categorizes and groups merchants into pre-defined categories. You can reassign any transaction to another category or a new one you create.

- Set a monthly budget per category—it automatically tracks uploaded card transactions against the budget so you can see remaining vs. spent. Delete payment lines (e.g., credit card payments) if they skew analysis.

- Add off-card spending manually and track it alongside.

- Use dynamic charts to analyze spending by category and merchant for both big-picture and detailed views.

6

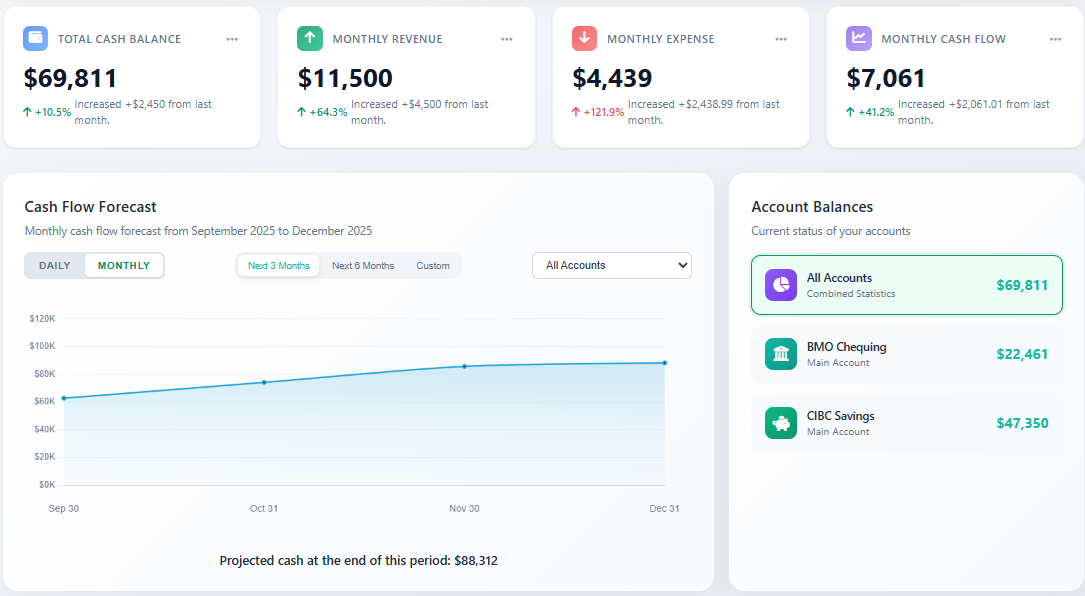

Visualize your financial overview and trends in Dashboard

- Gain instant visibility into your total cash, monthly revenue and expenses, and monthly net cash flow.

- Explore the cash flow forecast with a dynamic visualization.

- Illustrate the complete flow of your expenses out of your bank accounts.

Simple On-going Maintenance

1

Reconcile real balances weekly (stay mindful, stay accurate)

- Pick a dedicated day in a week to spend ~10 minutes scanning the forecast and tweaking any upcoming items.

- Log in to your bank and copy actual balances to reconcile ending balances in Cash Tracker.

- See how your net worth is trending based on current cash balances.

2

Analyze your past month spending monthly

- Spend ~5 minutes to upload the new credit card CSV and analyze last month’s habits; make adjustments for the upcoming months.

- Update non‑liquid assets and liabilities to current values to understand overall net worth trends.